How IT leaders are shaping the future of insurance

The role of IT leaders and CIOs in insurance has evolved from a necessary support function into an integral part of every firm’s strategic vision.

But how do you ensure your voice in the boardroom is influential enough to enact change and drive long-term growth across your organisation.

Whether you’ve already developed a five-year plan or feel the push from your COO or CEO to implement new technologies, it can be a challenge to balance day-to-day operations with wider strategic priorities, particularly around data security, AI and compliance.

In this report, we’ve gathered perspectives from IT leaders within several leading Lloyd’s of London firms to explore their most pressing challenges and unpack current industry trends.

Meet the contributors

Steve Jolley

Chief Information Officer

Miller Insurance Services

Paul Jackman

Chief Technology Officer

BMS Group

Steve Coldwell

Head of IT

Apollo

Tahwid Rahman

Chief Architect of Operations & Technology

IQUW

Overview

The Lloyd’s of London market has been a cornerstone of the global insurance industry since the 1600s. However, tradition has often hindered genuine change and innovation instead of driving it forward, making the role of many IT leaders particularly challenging.

Fortunately, there are promising signs that this is shifting. Market leaders are now recognising technology as a crucial element of their strategic vision, rather than merely a supportive function.

After speaking to industry leaders, we’ve identified the four key areas to focus on when gaining a stronger voice in the boardroom and set a foundation for long-term growth across your business.

OPERATIONAL EFFICIENCY

The balance between efficiency, scalability and cost

Cost control remains a top priority, but achieving greater efficiency goes beyond merely cutting budgets. It’s about harnessing the right technology to create smarter, faster, and more reliable processes.

While adopting new technologies and overcoming resistance to change can be challenging, IT leaders have incredible opportunities to drive innovation and transformation.

“At BMS, we’re focusing heavily on digitisation and operational efficiency. On one side, we’re driving straight-through processing by integrating workbench tools and messaging, along with market initiatives and data quality improvements aligned with Lloyd’s common data record standards.

On the other side, we’re focused on affinity and building different portals for self-service and online trading with both B2B and B2C principles in mind. Our goal isn’t just to streamline operations; it’s to actively drive revenue. We’re focused on balancing efficiency with growth, and removing the need for manual intervention while maintaining scalability."Paul Jackman, CTO at BMS Group

podcast

Strategic Visionaries: Redefining technology in insurance

In this special edition of the Technology Boardroom, Advania UK’s Peter Wilson hosts a discussion with two leading insurance industry figures, as Steve Jolley and Pete Robertson join the podcast to debate the evolving role of the CIO in the sector.

In ‘Strategic revolutionaries: redefining technology in insurance’, we examine how the role of CIO has shifted dramatically in recent years, propelled in part by the dramatic effects of Covid-19 as well as the rapidly evolving nature of business. With technology evolving at a rapid scale, the trio also underline the continued importance of investing in people to drive technological growth, with collaboration and partnership both equal parts in achieving long-term success.

From moving away from traditional paper-based operations to the adaptive requirements of the industry’s future, this episode offers a fascinating insight into the evolution of one of the world’s largest financial industries.

Artificial intelligence

The AI puzzle - and how to solve it

AI is set to revolutionise the insurance industry, but how can you separate the reality from the hype to ensure your business stays focused on delivering its essential functions?

Different companies have varying priorities. Some aim to improve risk placement accuracy, identify loss patterns and combat fraud. Others prioritise automating underwriting processes, streamlining administrative tasks and issuing policies more efficiently. Additionally, predictive models can be used to customise coverage options based on client profiles – the possibilities are extensive.

It’s crucial to implement AI with a clear purpose rather than adopting it simply because it’s popular, even if there’s pressure from stakeholders or investors. There’s no room to waste money on initiatives that don’t deliver tangible results, and that’s a trap IT leaders need to keep their firm from falling into.

“It starts by being realistic about what AI can and cannot do. It's not some silver bullet that will solve all our problems. Right now, AI tools can help accelerate decision-making and provide valuable data-driven insights. But it's certainly not going to fully automate everything or replace human effort. We need to be clear-eyed about the productivity gains and efficiency improvements the tech can realistically deliver.

My focus is on identifying specific use cases where AI can have a tangible, measurable impact: things like automating repetitive processes, providing decision support and generating insights from our data. But we have to be careful not to overhype AI's capabilities. It's about finding the right balance and applying it carefully to complement and elevate our human expertise. That’s still by far the most important factor in our growth.”Steve Coldwell, Head of IT at Apollo

Supporting forward-thinking insurance firms on their digital journey

Advania’s expertise spans across Microsoft Azure, Dynamics 365, Microsoft 365, Security and Data – and we’ve been supporting financial and insurance institutions across the full spectrum of Microsoft’s cloud capabilities, from infrastructure and platform services to enterprise productivity solutions.

1,200+

seats migrated to the Microsoft Cloud

50%

reduction in Central London office space requirements

35%

reduction in support incidents

“Working with our technology partner Advania, we adopted Microsoft Azure cloud technology, plus a breadth of cloud services, including SaaS, PaaS and IaaS.

By outsourcing the implementation and management of our infrastructure, we were able to go from a standing start to being a truly cloud-first organisation in the space of nine months.”

Erdal Atakan, CIO at Inigo

Data strategy

Data-driven foundations

Industry leaders are making significant investments in infrastructure to clean, manage and consolidate the numerous data streams dispersed throughout their organisations. This effort provides a solid foundation upon which they can develop analytics platforms, enabling underwriters to more easily generate and interpret new risk insights.

“Historically, the London market has relied on manual decision making and almost singular responsibility on the shoulders of actuaries and lead underwriters. But modern challenges now require quicker decisions. It’s not just about getting better at collecting risk-related data; the information also needs to be instantly consumable and quickly actionable."

Tahwid Rahman, Chief Architect at IQUW

Security, risk and compliance

Strengthen your weakest links

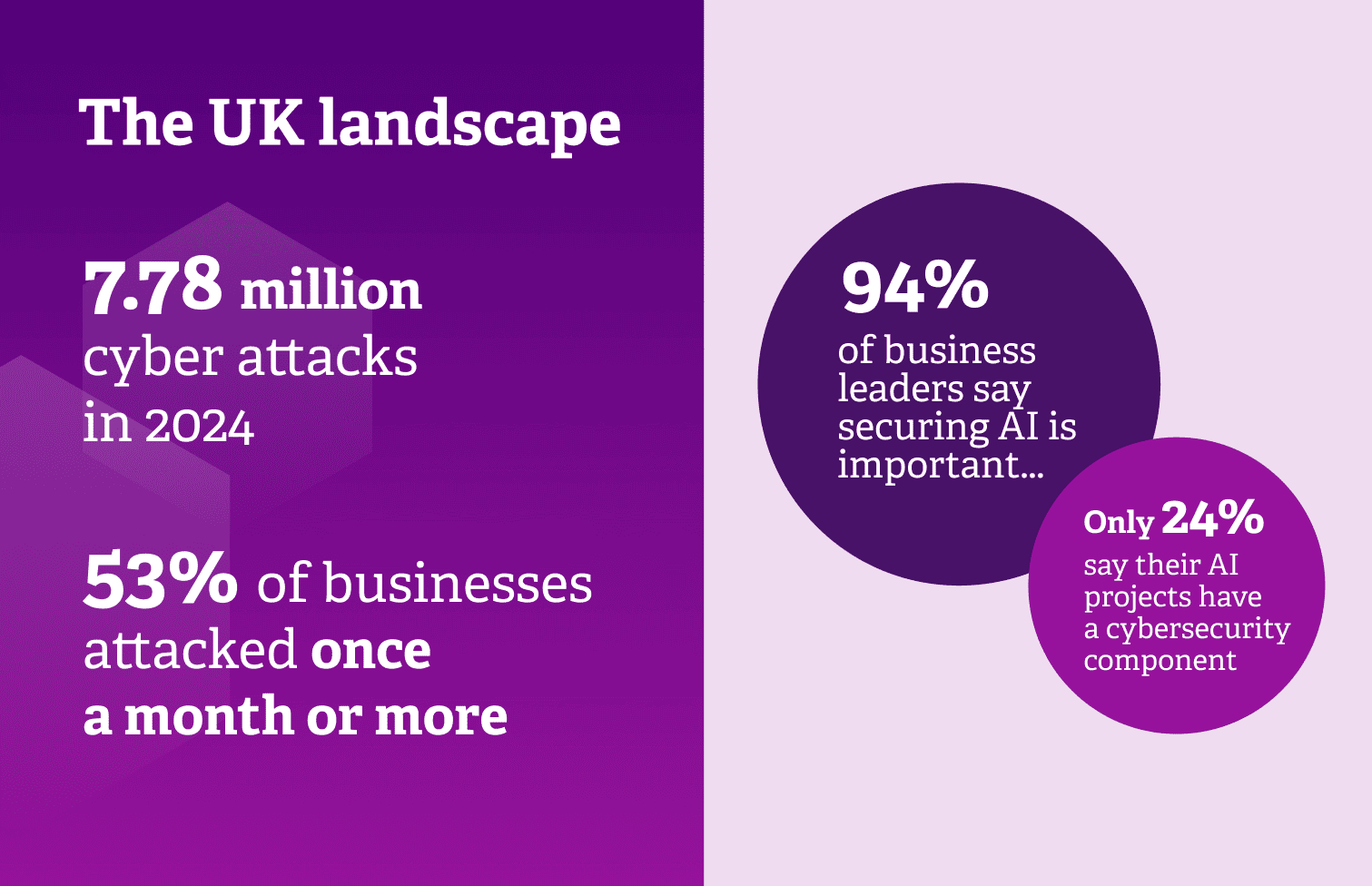

The risk posed to operations by cyber crime remains the greatest threat facing the global insurance market over the next two years according to PwC’s latest report on industry risks.

In terms of response, the latest stats from GOV.UK show that finance and insurance businesses typically treat cyber security as a higher priority compared with other industries, with 61% saying it’s a ‘very high priority’ for their organisation.

Insurers are also far more likely to have an incident response plan (51%, vs. 22% overall) among several of the other listed measures.

“In my view, we can only succeed in the long run if we get our structure and governance right, not just the technology. We need to be ‘always audit ready’ with a deep understanding of the regulatory landscape and a robust plan to mitigate risks. It's not enough to just react when the auditors come knocking."

Paul Jackman, CTO at BMS Group

Take the best next step in your digital journey

Digital transformation is an ongoing process, not a one-and-done project; yet knowing where to focus your efforts isn’t always straightforward, especially when your time and resources are spent managing day-to-day responsibilities.

Book a meeting with us today help you take stock of your current challenges, gain clarity over your strengths and weaknesses and talk through

your options with our subject matter experts.